- Best Retirement Planning Software For Mac

- Retirement Planning Software For Mac

- Retirement Planning Software Mac

- Retirement Planning Software Quicken

- Free Retirement Planning Software

I’ve used many retirement calculators. More than 80 at last count. I relied on these tools to plan my own retirement trajectory, culminating in early retirement at age 50. Then I started a blog and began reviewing retirement calculators. Over time, these posts have become the most popular on my site. I’ve recently updated my best retirement calculators list — the most comprehensive survey of retirement calculators available.

Other financial planning programs ask you to guess: How much do you need for a secure financial future? MaxiFi software ends the guesswork. It’s the only software powerful and accurate enough to calculate your highest sustainable living standard — starting today — with a plan to maintain and raise that amount — for life. Completely automate the financial planning of your lifetime traditional IRA and Roth IRA contributions, deductions, asset growth, withdrawals, and taxation with VeriPlan's fully integrated retirement investment calculator, retirement income calculator, and retirement withdrawal calculator software features. Quicken is the granddaddy of personal finance software. But over the years, it's made some big changes. Once upon a time, you had to go to the software store to buy an edition of Quicken. Now the software operates on a subscription model, so you just need to sign up and download it online.

Best Retirement Planning Software For Mac

Despite their shortcomings, retirement calculators are essential tools in preparing to leave a career. Nobody, not even a highly compensated financial advisor, can foretell the future. Projections from a retirement calculator are the best we’ve got. Just remember, a good retirement calculator is a set of binoculars, not an autopilot. It will give you some visibility into the future, but you still have to drive yourself there….

Retirement calculators come in all flavors. There are calculators with sexy, dynamic web interfaces. And there are spreadsheet-based calculators with dowdy, tabular interfaces perfect for geeks. There are simple, fast ones that will analyze your retirement savings in a few minutes. And there are sophisticated personal financial models that will attempt to optimize your retirement withdrawals decades from now.

Retirement planning is the process of setting goals for your retirement years and then creating a plan to fulfill those goals. Executing a retirement plan requires most people to put aside some of their current income for long-term savings and investment. You can use tax-sheltered vehicles, such as traditional individual retirement accounts (IRAs) and employer pension plans, to fund part of. In fact Personal Capital is easily the best retirement planning software for Mac available. It’s as secure as any bank out there Like any major financial institution, Personal Capital is registered with the Securities and Exchange Commission (“SEC”) and has to adhere to. The top five financial planning software programs used by professional financial advisers, according to a recent survey conducted by T3, Adviser Perspectives, and Inside Information are. In fact Personal Capital is easily the best retirement planning software for Mac available. It’s as secure as any bank out there Like any major financial institution, Personal Capital is registered with the Securities and Exchange Commission (“SEC”) and has to adhere to the same security standards and procedures.

After all the years, all the reviews, and all the number crunching, I find myself returning to a small subset of favorite high-fidelity retirement calculators. These are the “best of the best” when I need to perform detailed financial modeling. When you’re ready to dive deeper into your own financial picture, perhaps one of these will be perfect for you too. So here they are, in the order I discovered them:

J&L Financial Planner

Sometime in the early 2000’s, shortly after the idea of early retirement lodged in my head, I started writing a simple computer program to model our cash flow into the future. As the job got more complex, I decided to look around and see what other retirement modeling tools were available. At that time there was precisely one candidate that met my needs: the J&L Financial Planner.

Now, more than ten years later, it’s still a powerful and competitive tool. More often than not, when I need to model a retirement problem, I turn to the J&L Financial Planner first. For me, it has the most logical and optimal internal architecture for financial modeling. That means powerful and flexible account and event systems. And it offers superb traceability of results, logging every individual cash flow in every modeling year, so you can easily verify its calculations.

:max_bytes(150000):strip_icc()/bitcoin-mining-software-5b73752fc9e77c0057beb28f.jpg)

The J&L Financial Planner is available for Windows only. It performs average, historical, and Monte Carlo simulations, though its approach to historical simulations is offbeat. Surprisingly, for such a powerful tool, it doesn’t perform detailed marginal tax calculations. Otherwise, it offers just about every possible retirement modeling feature you can imagine. Sometimes those features are buried in the 1990’s-era Windows user interface. But, with a little time invested, there are virtually no retirement scenarios you can’t model accurately with the J&L Financial Planner.

Flexible Retirement Planner

Not long after starting this blog, as I began reviewing retirement calculators, I came across a single high-fidelity tool friendly enough that I could recommend it to anyone who wanted to do their own in-depth financial planning. The Flexible Retirement Planner impresses with its simple, clean, and professional user interface, married to a sophisticated financial model. For years, when I thought of the ideal interface for powerful financial modeling, I looked to the Flexible Retirement Planner first. That it is offered freely for non-commercial use, runs on the web and major desktop platforms, and comes with excellent documentation, are added bonuses.

Originally offered only on the web, The Flexible Retirement Planner is now available in download versions for desktop use. Its use of Java can sometimes lead to configuration issues, but once the software is running, it is generally an easy and reliable tool to use.

The Flexible Retirement Planner is a near-perfect perfect mix of simplicity and power. It starts with one input screen, where you can quickly generate results, but offers flexible financial events and simulation options under the hood. It also has very attractive and well-organized graphical and tabular output.

The Flexible Retirement Planner is missing historical simulations, using Monte Carlo by default, which can also be configured for average return. But it was one of the first calculators to offer variable spending policies.

The Flexible Retirement Planner remains a finely crafted and well-balanced tool. It is mature software now and development has slowed. However, thanks to its simple, general design, I expect it to remain a viable planning tool for years to come.

Retirement Planning Software For Mac

Pralana Bronze/Silver/Gold

In the fall of 2013 I received a detailed letter from a retired electrical engineer who, it soon became apparent, might be the only person in the world to have spent more time on retirement calculators than me! This was Stuart Matthews of Pralana Consulting. He had been hard at work on the financial simulation technology that has grown into the PRC product line. PRC2016/Gold, the latest version of his flagship offering, is very likely the most powerful retirement calculator on the planet right now.

The PRC calculators, created using Microsoft Excel, will run on either the Windows or Mac platforms. The user interfaces are efficient and functional but don’t have the polish or snap of the latest web and desktop software. Generally speaking, the products will be appealing to more technical users. However PRC/Bronze, available via free download, could be the easiest to use high-fidelity calculator on the market. It offers three simple input screens and generates long-term results that closely match those of PRC/Gold.

PRC/Silver, available at minimal cost, is basically PRC/Bronze but with support for three scenarios and lightweight sensitivity analysis. It allows the user to specify best, nominal, and worst settings for inflation and rates of return, and then presents those projections as an envelope of possible outcomes on an output graph. This is an alternative to more sophisticated Monte Carlo and historical analysis, and is probably more understandable to many people. It’s a simple, useful concept that almost any calculator could implement, yet Pralana was the first to offer it.

Retirement Planning Software Mac

PRC2016/Gold is by far the most powerful tool in the Pralana lineup. In addition to the numerous existing features, the latest version adds an area graph that integrates fixed rate, Monte Carlo, and historical analyses to illustrate the upper and lower ranges of likely outcomes. It adds a cash account with user-defined floor, to serve as an emergency fund. And it improves on the tax treatment of growth in taxable savings, which can now be handled as simple interest, capital gains when withdrawals are made, or a combination of the two.

PRC2016/Gold can also create an immediate annuity from a tax-deferred savings rollover, and model rental properties, investment loans, and personal loans. It offers an impressive “sensitivities evaluation” page that lets you dial various critical parameters up or down and observe the impact on your assets. There are also new optional withdrawal strategies applicable to discretionary spending. And consumption smoothing can now be based not only on fixed rate projections but also on Monte Carlo and/or historical analyses.

If you need the absolutely most powerful and flexible retirement calculator in 2016, your choice is clear.

OnTrajectory

In the fall of 2014 I was contacted by the developer of another newcomer to the retirement calculator scene. This offering targeted a younger audience working toward financial goals in the accumulation stage of their careers. Yet it offered a strong feature set for near-retirees too. And it targeted a new platform, with a slick, dynamically-updated web interface and easy-to-use graphical controls. This was OnTrajectory, a powerful and friendly new financial model.

OnTrajectory simply has one of the best user interfaces available in the retirement calculator world. The central graphical metaphor is instantly understandable. Anyone with the slightest interest in their money will feel immediately at home. The program is equally easy to use. You start by answering four simple questions, and then fine tune your results from there. And you can progress from low- to medium- to high-fidelity modeling in the same software. (OnTrajectory was recently promoted into the elite ranks of high-fidelity calculators on my Best Retirement Calculators list. )

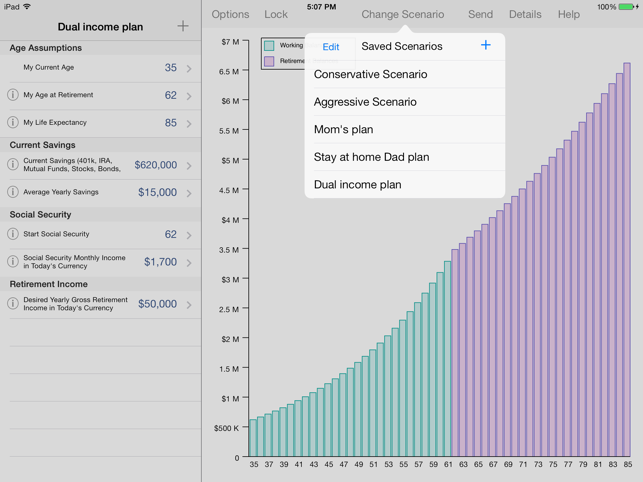

OnTrajectory doesn’t sacrifice powerful, modern modeling in offering a fun user interface. Digging deeper, it offers very rich income, expense, and account choices. It performs average return, historical, and Monte Carlo simulations. It doesn’t shy away from detailed tax calculations or RMDs either. Going further, it can save and manage scenarios for comparing complex alternatives. And, a unique feature, it lets you create your own financial goals and track your progress towards them.

Despite the feature set already delivered, OnTrajectory has not rested on its laurels. In conjunction with an Adviser Board of other leaders in the retirement calculator field, the team has continued hard at work. The plan is to keep implementing the best features of other financial modeling tools. Given its own trajectory to date, OnTrajectory is likely to soon find itself nearing the top of the retirement calculator heap!

Rise of the Personal Financial Model

Like the word retirement, the term retirement calculator is barely appropriate. I’m “retired” from my original career, but I still “work,” sometimes pretty hard, on this blog. In the same way, these favorite high-fidelity retirement calculators of mine don’t stop working after they’ve investigated your retirement. They continue on to analyze all phases of your financial life, helping you choose among the many complex alternatives for your money, making it last longer and do more than if you were flying blind and alone.

Stuart Matthews of Pralana Consulting continues to lead in retirement modeling, both with his software, and his thoughts on the subject. He’s suggested we use the term “Personal Financial Model” (PFM) for these advanced tools. Ultimately the market will decide, but I agree with his point. These tools can supplement basic budgeting or money management software, and are much more than just retirement calculators. In fact they are generalized financial models to improve decision-making at all stages of life: early career, young family, empty-nesters, near retirees, retirees, and survivors.

Retirement Planning Software Quicken

What makes for a true Personal Financial Model? The hallmarks include a mix of features: flexible financial events, variable portfolio mix, taxable/tax-deferred/tax-free accounts, detailed tax calculations, scenario analysis, average/historical/Monte Carlo simulations, and detailed, verifiable output. The most advanced offerings also include features to optimize specific financial scenarios in your future, such as Social Security claiming and IRA conversions.

Free Retirement Planning Software

These tools are OK for a quick check that your retirement savings are on track. But they were really designed for long-term relationships, built up and revisited over the years. Ultimately, for many of us do-it-yourselfers, they take on the role of sage financial advisers, integrating and leveraging computer intelligence to improve our financial lives.

Related Posts:

Join more than 18,000 subscribers.

Get free regular updates from 'Can I Retire Yet?' on saving, investing, retiring, and retirement income. New articles weekly.

You're Almost Done - Activate Your Subscription! You've just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

Unsubscribe at any time.